In the last few days since its announcement, I have been asked by friends about the upcoming release of Singapore Savings Bonds (SSB).

For some information on Singapore Savings Bonds, please visit:

Their biggest question is, “If everyone goes into SSB, does this spell the end of the endowment plan?”

I strongly doubt so.

Why?

While there are bound to be comparisons, because both SSB and endowment plans can be used for the objective of saving and investments, they are definitely NOT mutually exclusive.

- Difference in Terms and Rate of Returns

There are a wide range of endowment plans that can be structured into solving a multitude of problems.

Endowments are offered in different periods of time, while SSB have a term of 10 years.

You generally can’t always solve a long term problem with a short term solution.

Also, a plan with a longer term will usually provide a higher rate of return. In other words, you have to find out if the rate of return on SSB can help you to reach your goals.

- Both are Flexible but from Different Angles

Endowments come with many different options. You can also add on insurance riders to cater to your unique situation.

It can pay you an interest for cash flow needs, or allow you to reinvest your interest and compound it over time.

You will receive a lump sum with capital appreciation at the end of the tenure.

Endowments however, are usually designed to be kept till its maturity. Should you terminate the policy before it matures, you can almost be sure to lose out on either your principal or expected returns.

SSB on the other hand, provides fantastic cash-flow via coupon payments. It is extremely liquid as well and there is no penalty should you wish to redeem it at any given month.

- Difference in the Amount that can be Invested

There is no cap on how much you can save in an endowment plan; you can choose to set aside $888.88 or $123.45 just because you can.

But with SSB, there will be a minimum of $500, and in subsequent multiples of $500 up to a limit that will be announced in the future.

- Difference in Strategy

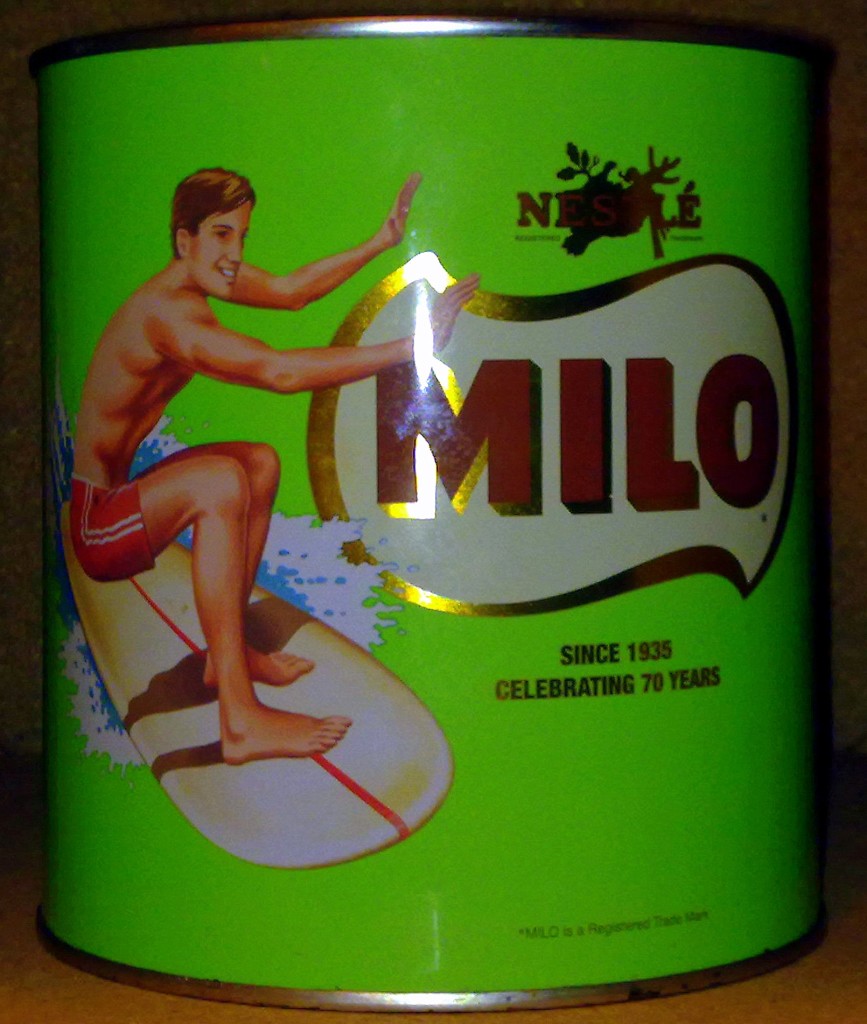

Endowments, with its forced savings function, work like a Milo Tin that our grandparents use to store their life long savings. Money only goes in, and doesn’t come out. Regardless of interest rate, Ah Gong knows exactly how much money he has locked up in his Milo Tin at the end of the day.

SSB works like a mix between our POSB savings account and fixed deposits. It is liquid and flexible, and pays a good rate of return at little to no risk.

However if saving is what you want to do, individuals who lack discipline are better off with another strategy, such as using Ah Gong’s trusty Milo Tin.

This is because regardless of the rate of interest, such individuals will still have trouble saving anyway.

I am referring to those (not you I am sure!) who are always tempted to eat at restaurants and by the latest gadget, and those who enjoy withdrawing their money to spend on holiday trips.

In conclusion, like what MAS says, I see SSB as a useful instrument that expands the range of low-cost investments options available to individual investors like you and me.

We can pick it up on its own, or complement it with other endowments/savings plans and investment plans, to achieve our financial goals.

Basic questions we need to ask ourselves when selecting these instruments are as follow:

- What is the purpose of my savings?

Often there is no need to take on unnecessary risks to get a higher rate of return when a low risk instrument can solve the problem just as well.

- At what level do I need flexibility (of cash flow)? Can I forfeit some of this for a higher rate of return?

The more cash flow you want, the lower your eventual accumulation.

- Do I have the discipline to save? Or should I commit to something that forces me to save and makes sure that I do not anyhow withdraw the money?

For a blueprint that you can use right away in your financial planning decisions, go to http://sengbingyang.com/insurance-tips-and-strategies/ now to download your free report.