As announced, MediShield Life will be launched in the 4th Quarter of 2015, and I’ve been asked by a number of friends regarding the latest developments.

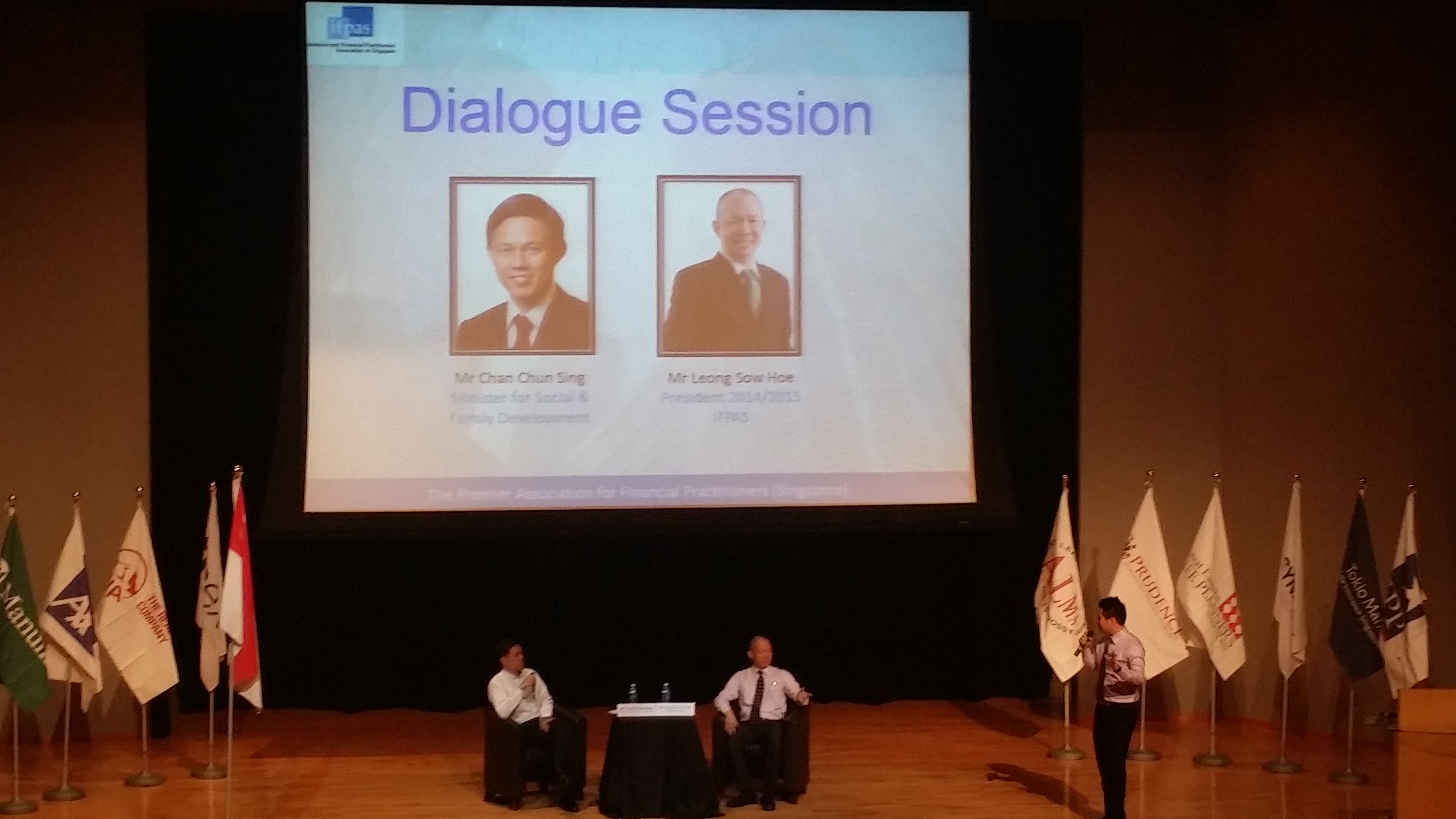

Last Friday, I attended a MediShield Life talk by Mr Chan Chun Sing as a volunteer to this new initiative.

As volunteers, we were tasked to disseminate the right information to the public; to help those who need further explanations and to manage any “red eye disease”, aka jealousy. This will be done through a series of programs, and through our everyday work.

In a nutshell, the birth of MediShield Life can be summarized into the following:

1 Objective:

i. Peace of mind for all Singaporeans for their healthcare needs

2 Fundamental principles:

i. We need to take ownership for our own healthcare needs.

ii. Do more for those with less, and do most for those with least.

3 Conflicts/Headaches:

i. Universal health care and insurance may bring about moral hazard. Singaporeans need to continue to take ownership for their own healthcare needs regardless of their financial backgrounds, or else the programme will be abused.

ii. Managing medical cost inflation: With insurance in place, there will be cases whereby patients seek what they want rather than what they need, which would inevitably drive up medical costs and thus future MediShield premiums.

iii. Conflicts of interest may arise between agents and clients, and it is important for agents to prescribe the correct policy based on clients’ needs and affordability.

Previously, it was premature and unnecessary for me to comment while details were still being finalized. Nonetheless I recommended those who have a premium integrated plan to sit on their plan and to not speculate on the changes made to MediShield.

More information will be released in due course.

On top of that, I informed friends who wanted to upgrade their plans of the likelihood of a premium increase when MediShield Life is launched, and that that has to be taken into consideration when making their decision.

Something that may occur is that of Singaporeans depleting their MediSave over the years due to inappropriate usage, and being unable to afford MediShield premiums in their old age, which is a time when they need the insurance cover the most.

Thus, part of financial planning requires us to cater to our medical needs, including medical insurance premiums that will be activated in old age.