Now that the dust has settled, this is my little tribute to Mr. Norman Levine, a legend in the life insurance business who’d given more than 60 years of his life to this industry.

(Appreciate the kindness shown by several associates and even a couple of friends outside of the industry who informed me of his passing.)

Thanks to a connection or two, I was fortunate enough to meet Mr. Norman Levine over dinner some years ago when I first stepped into this industry. I always kinda knew what I wanted, but I wasn’t sure what to expect or how to get there. Of course, I am still learning today (always am), but whenever I’m asked how come I behave so differently with regards to my career when compared to some of our fellow practitioners, I would candidly attribute this to Norman and how he ‘brainwashed’ me over a meal.

Being extremely green then, I still remember clearly how I timidly walked along the perimeter of the dining table and squatted down next to Norman while he enjoyed his Beijing Duck.

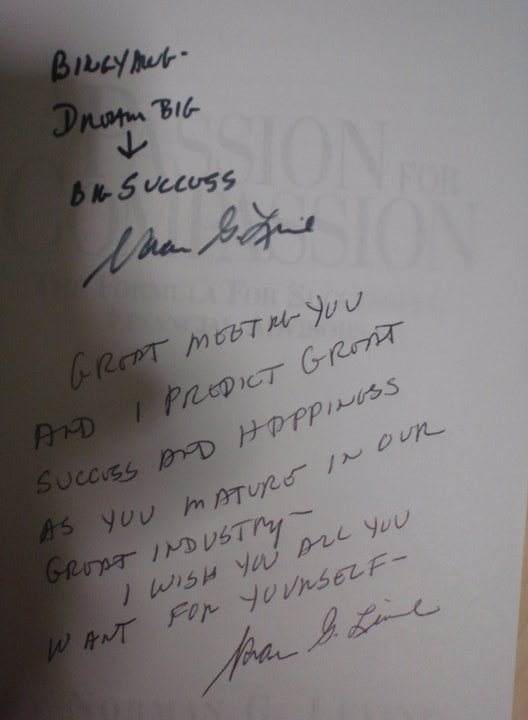

Lacking EQ perhaps, because the man was obviously eating, I asked if he could add a few words to my copy of his best-selling book. He happily obliged and selflessly offered me some priceless advice.

He told me a few things.

First of all, he said that I should strive to quickly move away from peddling products and towards being a problem solver.

The essence of this business is that of providing solid financial advice and holistic financial planning. Incidentally, our fees for service are built into the products that are recommended to solve people’s problems. A product peddler is nothing more than an order taker, who adds little value to the people he serve and who will be phased out as clients get more sophisticated.

He suggested that I pursue my professional examinations and earn the right to hold prestigious designations like Chartered Life Underwriter (CLU) because it would allow me to speak with conviction and to help others in ways that many cannot.

To be very honest, I have never looked at the business that way until he told me that.

Then, he looked me in the eye, and said along the lines that I am a young man, it will take time but I will enjoy the ride. And regardless of what happens, to have unshakable belief in what I do and everything will be okay.

I also remember vividly the few of us guys walking out the restaurant after dinner, and as we strolled along One Fullerton, he asked me what insurance programmes people here in Singapore are signing up for. Without any statistics, I simply replied that many Singaporeans are involved in Investment-Linked Products (ILPs), for whatever reasons. Norman chuckled, “You should see what’s happening in America…” He then looked ahead, smiled and commented about how beautiful Singapore is.

That last statement, I’m sure, was probably just a comment in passing, but it made me develop a keen interest in studying literature from the many greats including Norman himself, which documented the developments of the insurance business over the years. That was the lesson I took away anyway : )

Thank you Sir. Your legacy will continue to live on in many of us around the world!